The PNG 100 CEO Survey 2017: business confidence in Papua New Guinea

This is the sixth year that Business Advantage International has run the PNG 100 CEO Survey—our exclusive survey of the executives who run PNG’s largest companies.

Each year, the survey aims to reveal levels of business confidence by asking CEOs about their anticipated profit levels and expectations for investment and recruitment in the year ahead. They also identify the key issues that they face in their businesses.

Profits mixed

Twelve months ago, when we asked the CEOs what their profit expectations were for 2016, they were optimistic. Half thought profits would ‘substantially’ or ‘somewhat’ exceed the levels of 2015.

A year on and that optimism has proved to be overstated, although the picture is nuanced. Just five per cent of CEOs say profits substantially exceeded expectations, while a quarter say theyhad experienced slightly better profits. Thirty per cent say profits were what they expected, while 22.5 per cent say profits were slightly below expectations. About 17.5 per cent say they recorded profits substantially below expectations.

What will 2017 bring?

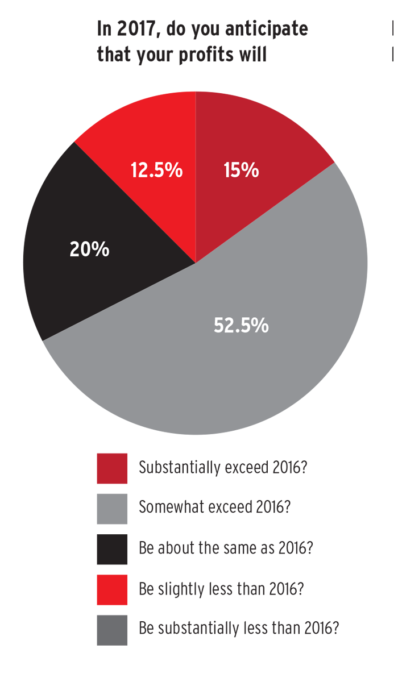

Despite a sustained economic slowdown business leaders are optimistic. More than two-thirds (67.5 per cent) believe that profits will rise this year, an increase in the level of optimism in the previous year. Fifteen per cent of CEOs expect profits to be substantially up, while no CEO expects profits to be substantially lower in 2017 than they were in 2016.

Investment and employment intentions

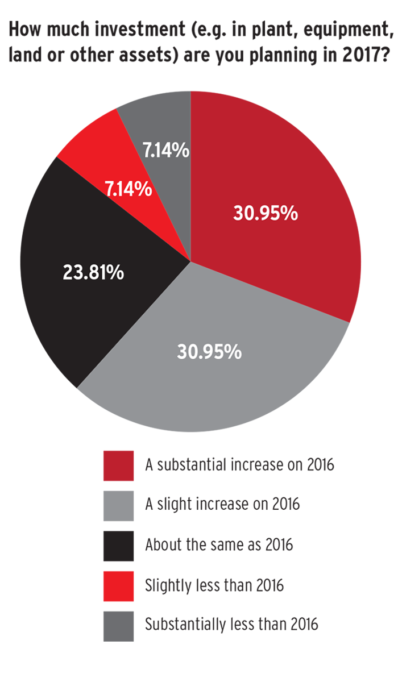

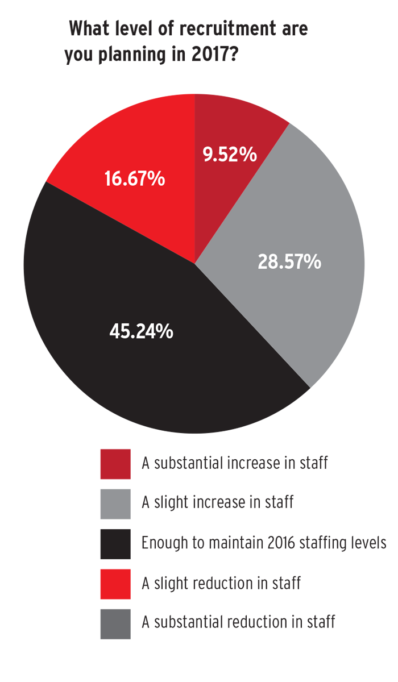

Two useful indicators of economic confidence are how much business leaders intend to invest and how many new people they intend to employ. The patterns of intended investment are more bullish than anticipated employment levels.

About 31 per cent of respondents said they expected to make a ‘substantial’ increase in investment this year. The same level expected to make a slight increase in investment. Only 14.3 per cent expected to make substantially, or slightly, less investment, compared with 22.6 per cent in the previous year.

Recruitment expectations are less positive. While no CEO expects a substantial reduction in staff numbers (3.23 per cent expected this in the previous year), the majority, 45.2 per cent, expect staffing to remain unchanged.

More than a quarter (28.6 per cent), expect to make slight increases in recruitment, while 9.5 per cent are anticipating a substantial increase—a figure that was down from 19.3 per cent in the previous year.

Issues facing PNG business

Once again, access to foreign exchange is regarded as the most critical issue. It was nominated as the major obstacle by 59.5 per cent of CEOs, considered more than double any other challenge.

Other issues nominated as ‘critical’ by respondents were: shortage of expertise and skills (28.6 per cent of respondents); unreliable telecommunications (28.6 per cent); security and law and order (24.4 per cent).

The 2017 PNG 100 CEO Survey was conducted by Business Advantage International between late November 2016 and early February 2017. The survey included senior executives from a representative sample of Papua New Guinea’s largest companies, across all sectors of the economy.